who claims child on taxes with 50/50 custody georgia

Who Claims a Child on Taxes With 5050 Custody. The parent with whom the child.

Georgia Custody And Visitation Schedule Guidelines Ga

For a confidential consultation with an experienced child custody lawyer in Dallas.

. Whoever has custody for the greater part of the year as often stipulated in the divorce settlement typically gets to claim the child unless the court rules otherwise. However if the child custody agreement is 5050 the IRS allows the parent with the. Assuming this is a 5050 custody arrangement between two parents with no third party involved and the parents dont file a joint tax return the priority would be.

But there is no option on tax forms for 5050 or joint custody. Shared custody can create a situation where one parent gets to claim the child as a dependent. Often in the case of 5050 custody and similar financial contribution from the parents the court orders that the parents take turns in claiming for the child.

The IRS has put rules in place to make tax filing fair for parents who have 5050 custody. Assuming this is a 5050 custody arrangement between two parents with no third party involved and the parents dont file a joint tax return the priority would be. Who handles an assortment of domestic cases including divorce child custody child support.

The custodial parent as defined by the IRS claims the child tax credit in a 5050 division. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. Who Claims a Child on US Taxes With 5050 Custody.

So the parent with the higher adjusted gross income gets to claim the child as a dependent on their taxes even if they spend. Having a child may entitle you to certain deductions and credits on your yearly tax return. We can do the same for you call us at 770 479-1500 for a confidential consultation today.

In some cases divorced or unmarried. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. We Help Taxpayers Get Relief From IRS Back Taxes.

The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household. But if the custody agreement mandates that its a 5050 split then the parent with the higher adjusted gross income gets to claim it. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns.

In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. The parent with whom the child. But there is no option on tax forms for 5050 or joint custody.

But there is no option on tax forms for 5050 or joint custody. The IRS only recognizes physical custody which parent the child lived with the greater part but over. It is again important to understand that Texas does not use the term custody in terms of.

In a joint custody agreement the custodial parent can claim the child as a dependent. The Internal Revenue Service IRS typically. Ad You Have Rights.

We Win Cases Free Evaluation Get Started. Typically when parents share 5050 custody they alternate between odd and even years on which parent claims the child. Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim the child.

In this way both parents if eligible have the. So one parent claims for the child. There is no such thing in the Federal tax law as 5050 split or joint custody.

Get Your Free Settlement Claim Review With A Top Law Firm Now.

Can My Ex Claim My Children On Taxes New Beginnings Family Law

Child Attorney Trial Notebook For Deprivation Cases In Georgia S

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

Non Custodial Parent Tax Rights Order Discounts 46 Off Public Locksmith Com

Who Claims A Child On Taxes In A 50 50 Custody Arrangement

Who Pays Child Support In Joint Custody

What Does Child Support Cover Findlaw

Study Finds That Equal Custody Arrangements Narrows The Gender Pay Gap

Custody Does Matter When Filing Your Taxes 2020 Update Andalman Flynn Law Firm

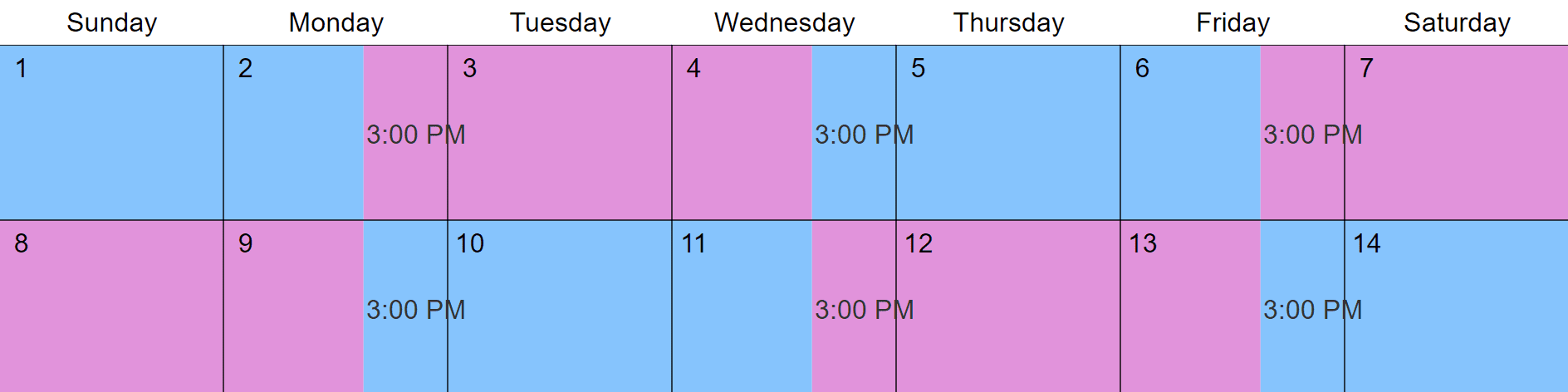

5 2 2 5 Parenting Schedule Joint Physical Custody Williams Divorce

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

Deciding Custody Visitation The Epps Law Group

Can You Claim Your Children As Dependents If You Don T Have Custody

Georgia Child Custody Laws For Unmarried Parents Sharon Jackson Family Law Attorney

Ky House Passes Updates To Child Support Laws Shared Custody Guidelines

Non Custodial Parent Tax Rights Order Discounts 46 Off Public Locksmith Com

Homepage Georgia Child Custody Racket